-

The cyclical bull rally starting in October 2022 is expected to last into 2025, according to Ned Davis Research.

-

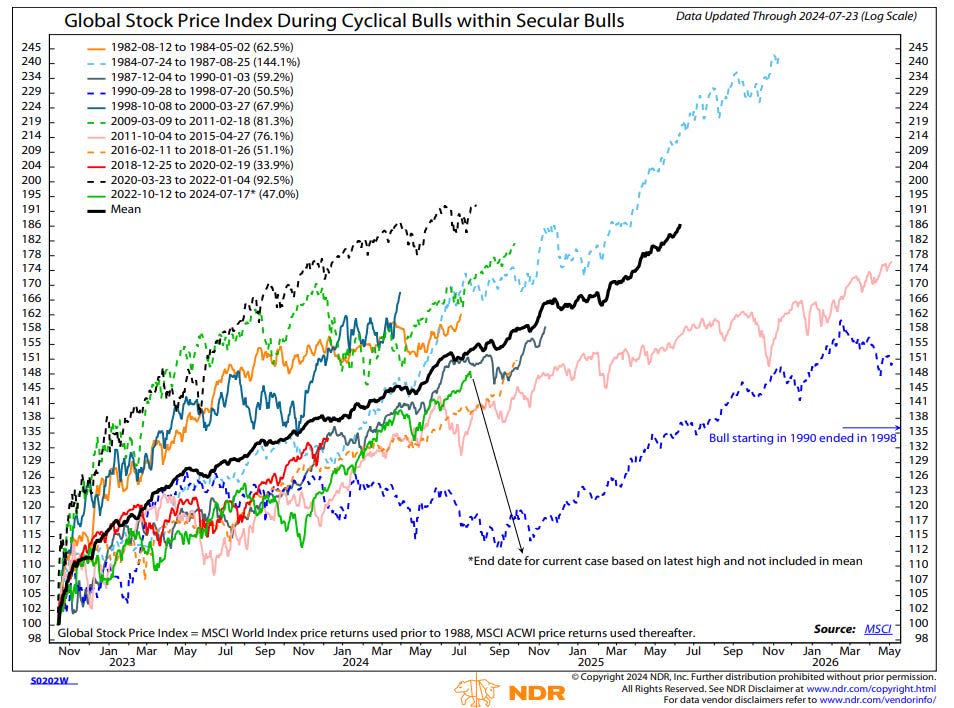

The firm highlights a chart that shows the historical trends of cyclical bull market rallies, and when they typically end.

-

“We expect to remain overweight equities, with the correction leading to a buying opportunity,” it said.

The cyclical bull rally that started in October 2022 is set to last well into 2025, according to historical trends highlighted by Ned Davis Research.

The research firm published a note last week that included a chart illustrating prior cyclical bull rallies within a secular bull market, as is the current rally.

What Ned Davis Research found is that the average rally, based on the start date of the October 2022 stock market bottom, should last into the summer of 2025.

And it could last even longer into 2026 if it follows the footsteps of the 2011 to 2015 cyclical bull rally, or well into 2030 if it follows the path of the technology-fueled cyclical rally of 1990 to 1998.

The bullish outlook from Ned Davis Research comes amid a slight correction in the stock market, with the Nasdaq 100 falling nearly 10% from its recent peak in July.

But the correction is just that, a short-term decline, and it doesn’t mark the end of the bull rally, according to the note.

“The global soft landing evidence and accommodative monetary policies continue to bode well for long-term equity performance,” Ned Davis Research said. “We expect to remain overweight equities, with the correction leading to a buying opportunity.”

The research firm currently recommends its maximum overweight target to equities at 70% in a balanced portfolio, with the remaining 25% and 5% being allocated to bonds and cash, respectively.

Ned Davis Research said risks of a new bear market remain low, and that the current correction in stocks is perfectly normal given the seasonal weakness during the summer.

Solid valuations, subdued investor sentiment, an ok macro environment, and falling bond yields mean “the weight of the evidence has remained consistent with an ongoing secular bull,” Ned Davis Research said.

To monitor the current health of the bull rally in stocks, the research firm suggests investors closely monitor earnings results.

The rate at which US companies are beating analyst profit estimates has topped 75% for five straight quarters, according to the note, and results announced so far for the second quarter suggest the streak will increase to six straight quarters.

But if momentum in the earnings beat rates starts to decline, that would be a warning sign.

“If the beat rate starts declining with momentum turning negative, the increasing disappointment could trigger more selling. But if the beat rate remains elevated as the earnings season matures, the chances for a market recovery will improve,” Ned Davis Research said.

Ultimately, the recent correction “should give way to another leg higher in the continuing bull market,” Ned Davis Research concluded.

Read the original article on Business Insider