(Bloomberg) — Stocks struggled for direction as a watchful tone spread across global markets before the Federal Reserve’s interest-rate decision.

Most Read from Bloomberg

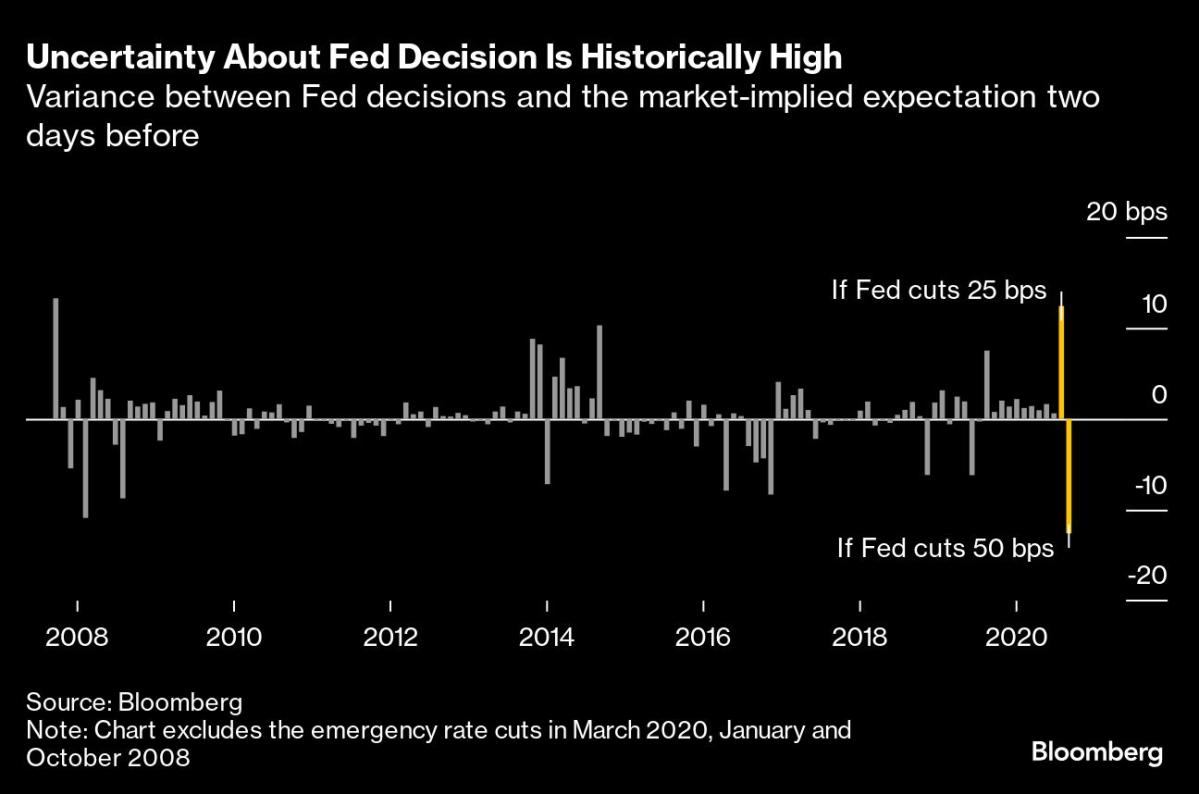

Traders are split over whether the US central bank will announce a cut of 25 or 50 basis points later Wednesday, with market-implied odds on the bigger move currently at 50%.

Investors are looking for the Fed to ease policy sufficiently to respond to recent signs of weakness in the economy, without stirring concerns that conditions are worse than markets appreciate.

“If they’re doing 25 basis points this time, the likelihood that they can get to a hundred basis points by year end is pretty slim,” said Justin Onuekwusi, chief investment officer at St James Place Management. “So if you don’t get 50, then you’re going to get significant moves in market pricing.”

Subscribe to the Bloomberg Daybreak podcast on Apple, Spotify or anywhere you listen.

US equity futures were steady, while healthcare stocks led Europe’s Stoxx 600 index lower. The dollar slipped and Treasury yields ticked higher.

The Japanese yen climbed as much as 0.8%, signaling expectations of a narrowing divergence in policy between the Fed and the Bank of Japan, which decides on rates on Friday.

In corporate news, Alphabet Inc. gained in US premarket trading after its Google unit won a court fight over competition with the European Union. Aperol maker Davide Campari NV’s shares fell 6.7% as its chief executive officer resigned after just five months.

In the UK, money markets see the Bank of England delivering modestly less easing after services inflation rose to 5.6% in August from 5.2% in July, while the headline figure held at just above the 2% target. The pound strengthened after Wednesday’s data.

Forecasters largely anticipate the Federal Open Market Committee will reduce rates by a quarter point to a range of 5% to 5.25%, though a number expect a half-point move. Investors see even odds of a half-point adjustment.

Fresh quarterly projections in the form of the so-called “dot plot” released at the end of the central bank’s two-day meeting will offer further insight into the path ahead for borrowing costs and the economy. Chair Jerome Powell will also hold a press conference.

“Given the market noise, I now expect them to go for half a point,” said Francois Rimeau, a strategist at La Francaise Asset Management. “Powell’s comments, the dot plot, the economic forecast, all of that will be at least as important as the cut itself.”

In Asia, a gauge of regional stocks edged lower. Chinese equities listed on mainland markets were modestly higher after a holiday break, shrugging off the gains in Hong Kong amid calls for major economic stimulus.

Chinese chip-related stocks jumped after the nation claimed a breakthrough in the development of homegrown chip-making equipment. Shanghai Zhangjiang High-Tech Park Development jumped by the daily 10% limit, while Changchun UP Optotech and Sai Micro Electronics also rallied.

Oil turned lower after a two-day gain as traders assessed indications of higher US stockpiles, rising tensions in the Middle East, and the likely course of the Federal Reserve’s rate path. Crude jumped Tuesday after thousands were hurt in what Hezbollah labeled an attack by Israel involving pagers in Lebanon.

Key events this week:

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Eurozone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.4% as of 10:26 a.m. London time

-

S&P 500 futures were little changed

-

Nasdaq 100 futures were little changed

-

Futures on the Dow Jones Industrial Average rose 0.1%

-

The MSCI Asia Pacific Index was little changed

-

The MSCI Emerging Markets Index fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.2% to $1.1136

-

The Japanese yen rose 0.5% to 141.63 per dollar

-

The offshore yuan rose 0.3% to 7.0873 per dollar

-

The British pound rose 0.4% to $1.3219

Cryptocurrencies

-

Bitcoin fell 0.2% to $60,001.22

-

Ether fell 1.1% to $2,318.29

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 3.66%

-

Germany’s 10-year yield advanced three basis points to 2.17%

-

Britain’s 10-year yield advanced five basis points to 3.82%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from James Hirai, Winnie Hsu and Margaryta Kirakosian.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.