Apple Inc (NASDAQ:AAPL) stock sports a 21.7% year-over-year lead, but is already down 6.5% in 2024. The shares are today pacing for their third-straight daily drop, last seen down 0.2% at $180.76, and have recently slipped back below familiar pressure at the $166 level. AAPL hit a Dec. 14, record high of $199.62, and thanks to a historically bullish trendline may soon notch a fresh peak.

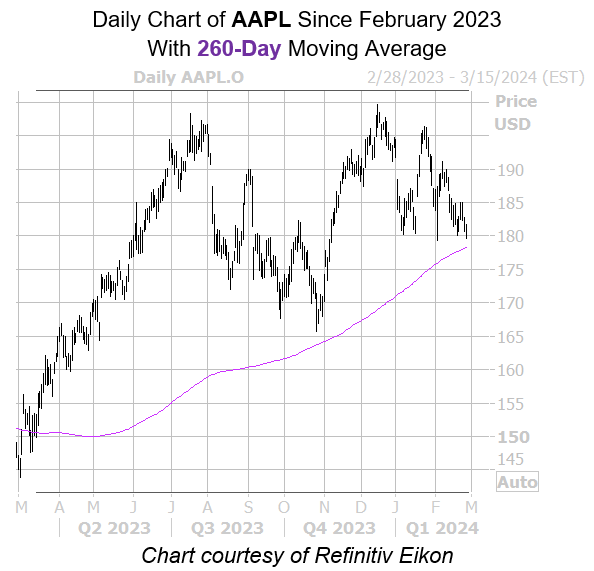

Apple stock is within one standard deviation of its 260-day moving average. Per Schaeffer’s Senior Quantitative Analyst Rocky White’s data, the equity saw three similar signals in the past three years, defined for this study as having traded north of this trendline 80% of the time in the last two months, and in eight of the last 10 trading days.

Just one month later after 67% of those instances, the security was higher, averaging an 11.8% gain. A comparable move from its current perch would place AAPL at a brand-new record high of $202.08.

Now looks like the right time to speculate with options, too, which are affordably priced. Apple stock’s Schaeffer’s Volatility Index (SVI) of 19% sits higher than 19% of readings from the last 12 months — a relatively low reading.