Artificial intelligence (AI) was a hot investing theme in 2023 and billions of investing dollars found their way into this technology this year, leading to windfall gains for certain companies that were savvy enough to make the most of the early adoption of AI.

According to Goldman Sachs, private investments in AI could hit $110 billion this year globally and increase to an impressive $200 billion by 2025. Nvidia, Microsoft, and Alphabet are some of the obvious names that investors have been piling into to take advantage of this huge opportunity. At the same time, some smaller companies could be big beneficiaries of AI adoption thanks to the markets they serve.

Palantir Technologies (NYSE: PLTR) and SentinelOne (NYSE: S) are two companies for whom AI is likely to be a big catalyst. While Palantir is a leading player in the market for AI software platforms, SentinelOne is setting itself up to capitalize on the growing deployment of AI within the cybersecurity niche.

But if you were to choose one of these two stocks to benefit from AI’s growth, which one should you buy? Let’s find out.

The case for Palantir Technologies

Palantir Technologies is known for building and deploying software platforms for both government and commercial customers, and the company is now using its expertise in the AI market as well. It is estimated that Palantir’s opportunity in the AI software platform market could be as huge as $1 trillion in the long run, and the good part is that the company is well-placed to capitalize on this opportunity.

That’s because Palantir was ranked as the top vendor of AI, machine learning (ML), and data science solutions per a third-party research report, ahead of the likes of Alphabet and Microsoft. More importantly, Palantir has already started landing AI-related contracts. In September, Palantir was awarded a $250 million contract by the U.S. Army to carry out AI/ML-related research work. This was followed by a one-year extension worth $115 million to an existing U.S. Army contract for providing new AI capabilities.

At the same time, Palantir saw a nice jump in the number of commercial customers it serves thanks to the growing adoption of its AI platform. In just five months, the company’s AI platform has been used by almost 300 organizations across multiple industries. Not surprisingly, Palantir’s overall customer count was up 34% year over year last quarter, driven primarily by a 45% year-over-year jump in the commercial customer base.

What’s more, Palantir is working aggressively to broaden its AI sales funnel among commercial customers. That’s why the company conducted 140 boot camps, or training programs, last month to help potential customers understand how to deploy AI for their use cases. These moves seem to be the reason why Palantir increased its full-year revenue and operating income guidance despite seeing softness in the government spending environment.

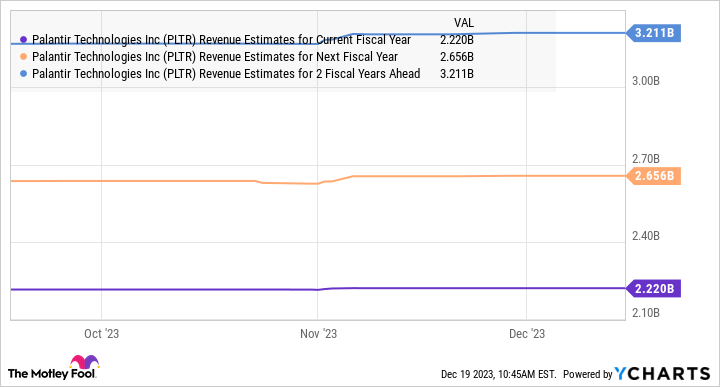

Palantir expects to finish 2023 with a 16.5% year-over-year increase in revenue to $2.22 billion. Even better, the company’s growth rate is expected to get better from 2024.

So, emerging catalysts such as AI could help Palantir stock sustain its outstanding momentum on the market following 178% gains in 2023.

The case for SentinelOne

Cybersecurity companies focus more now on integrating generative AI within their offerings. That’s because generative AI-fueled cybersecurity spending is anticipated to jump from just $9 million in 2022 to $3.2 billion in 2027. This is an opportunity for SentinelOne to quickly ramp up its business and attract more cybersecurity customers.

SentinelOne already provides an autonomous, AI-enabled threat prevention, detection, and response platform known as Singularity. The company can target the extended detection and response (XDR) cybersecurity market with this platform, which is forecast to grow 38% annually through 2028. At the same time, SentinelOne started selling its Purple AI generative AI cybersecurity analyst to customers and has integrated the functionality into the Singularity platform.

According to SentinelOne, this generative AI-powered security solution will allow an organization’s cybersecurity analysts to become quicker and more efficient by enabling them to use text-based prompts to look for threats, analyze them, and eventually respond to the threats. Market research firm Canalys estimates that over 70% of businesses are likely to adopt generative AI-based cybersecurity tools by 2028.

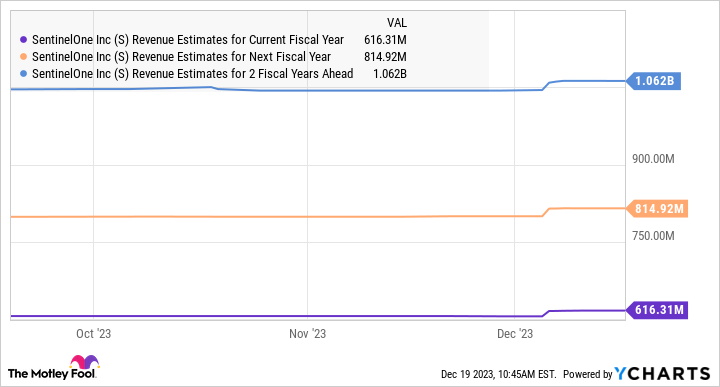

As a result, it won’t be surprising to see SentinelOne sustain its impressive growth. The company’s fiscal 2024 revenue guidance of $616 million would be a 46% jump over its fiscal 2023 revenue of $422 million. Management thinks SentinelOne can sustain a 30% revenue growth rate for the next two fiscal years as well.

But don’t be surprised to see the growing adoption of generative AI in the cybersecurity niche driving stronger growth at SentinelOne, which could allow this cybersecurity stock to jump higher following 83% gains in 2023.

The verdict

Both Palantir and SentinelOne could witness a solid jump in their businesses thanks to AI. However, investors looking to choose one of these AI stocks over the other have an easy decision to make.

While Palantir stock trades at almost 19 times sales, SentinelOne is cheaper, with a price-to-sales ratio of 13.5. SentinelOne is also growing at a much faster pace than Palantir. What’s more, as the charts in the article indicate, SentinelOne could keep outperforming Palantir over the next couple of years as well.

As such, investors looking to buy an AI stock right now that’s growing at a nice clip and isn’t very expensive may be tempted to buy SentinelOne, as it appears to be the better choice when compared to Palantir, based on its faster growth and relatively attractive valuation.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Goldman Sachs Group, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

Better AI Stock: Palantir Technologies vs. SentinelOne was originally published by The Motley Fool