(Bloomberg) — European stocks and US equity futures rose as traders looked forward to a final set of economic data for clues on the size of Wednesday’s Federal Reserve interest-rate cut.

Most Read from Bloomberg

Retailers led the advance in Europe’s Stoxx 600, while Nasdaq 100 contracts climbed, signaling a rebound after Monday’s rotation out of tech megacaps on Wall Street. Intel Corp. rallied 8.1% in premarket after the chipmaker won new business from Amazon.com Inc. The dollar steadied following a four-day decline and Treasury yields edged lower.

Listen to the Bloomberg Daybreak Europe podcast on Apple, Spotify or anywhere you listen.

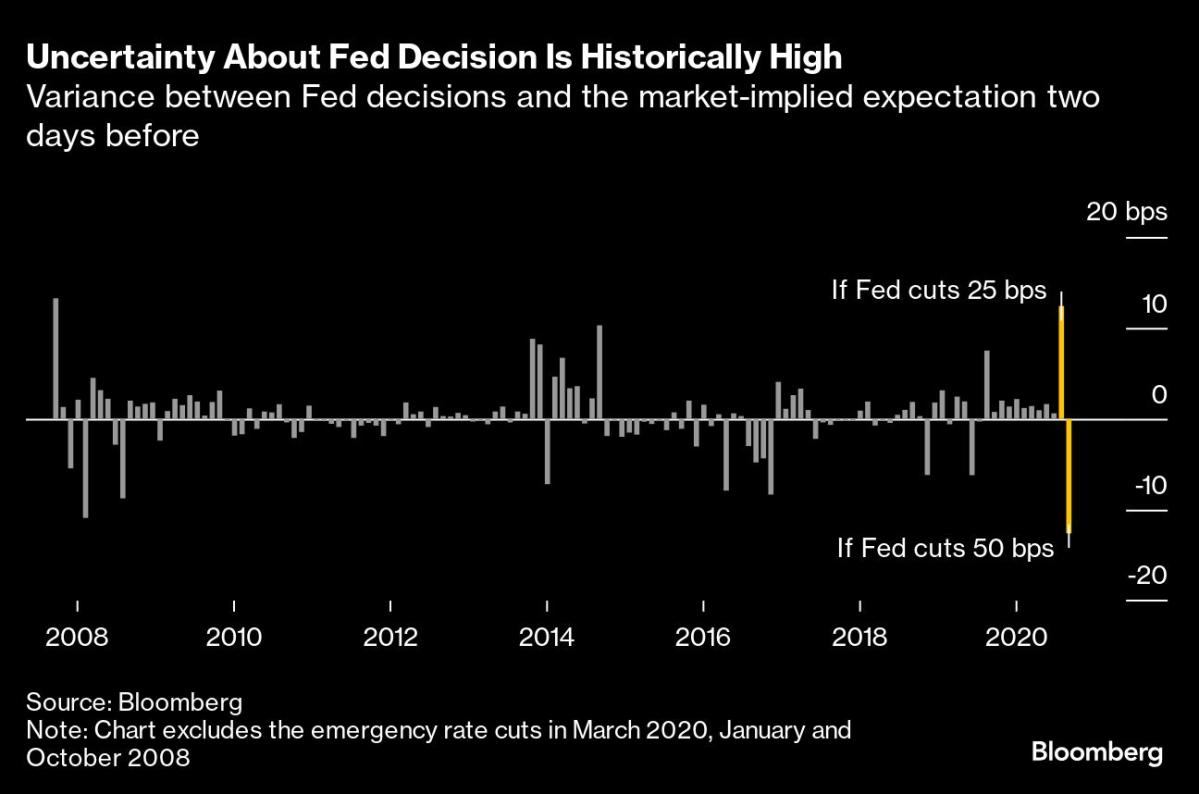

On the eve of the Fed’s first rate cut in more than four years, investor attention will home in on US retail figures due later. Opinion in markets is divided between expectations that the Fed will cut by 25 basis points, or by 50.

“August’s US retail sales report is, arguably, the most important of today’s releases, given that a soft print would likely see participants go ‘all-in’ on the idea of a jumbo 50 basis point Fed cut tomorrow,” wrote Michael Brown, a strategist at Pepperstone Group Ltd., in a note. “Though it’s tough to imagine an equally aggressive paring of dovish bets were the data to beat expectations.”

Former Federal Reserve Bank of New York President Bill Dudley is among those expecting a 50 basis-point move. “Monetary policy is tight, when it should be neutral or even easy,” he wrote in a Bloomberg column. “And a bigger move now makes it easier for the Fed to align its projections with market expectations, rather than delivering an unpleasant surprise not warranted by the economic outlook.”

For Jacques Henry, head of cross-asset research at Silex in Geneva, such a large reduction is “a double-edged sword,” as it could suggest the Fed is worried the US economy is slowing faster than expected.

The quarter-point cut he expects brings the risk of some short-term disappointment for equity markets. “There could be some drawback on sectors such as real estate and tech,” Henry said.

Meanwhile, optimism around Fed rate cuts has boosted investor sentiment for the first time since June, according to a global survey by Bank of America Corp. Fund managers see a 79% chance of a soft landing as rate cuts support the economy.

Still, investors are “nervous bulls,” with risk appetite tumbling to an 11-month low, said BofA strategist Michael Hartnett. The poll also showed a big rotation into bond-sensitive sectors such as utilities from those that typically benefit from a robust economy.

In commodities, gold remained near record levels Tuesday, with traders betting bullion will benefit from a weaker dollar and lower Treasury yields following the Fed decision. Oil edged higher.

Key events this week:

-

Germany ZEW, Tuesday

-

US business inventories, industrial production, retail sales, Tuesday

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Euro-zone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 rose 0.5% as of 9:53 a.m. London time

-

S&P 500 futures rose 0.2%

-

Nasdaq 100 futures rose 0.4%

-

Futures on the Dow Jones Industrial Average rose 0.1%

-

The MSCI Asia Pacific Index was little changed

-

The MSCI Emerging Markets Index rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1142

-

The Japanese yen was little changed at 140.54 per dollar

-

The offshore yuan was little changed at 7.0949 per dollar

-

The British pound was little changed at $1.3224

Cryptocurrencies

-

Bitcoin rose 1.9% to $58,764.11

-

Ether rose 1.6% to $2,309.72

Bonds

-

The yield on 10-year Treasuries was little changed at 3.61%

-

Germany’s 10-year yield declined one basis point to 2.11%

-

Britain’s 10-year yield declined two basis points to 3.74%

Commodities

-

Brent crude was little changed

-

Spot gold fell 0.2% to $2,577.99 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Jason Scott, Masaki Kondo, Aya Wagatsuma, Julien Ponthus and Margaryta Kirakosian.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.