Berkshire Hathaway CEO Warren Buffett made his name as one of history’s most successful investors using a value-oriented approach. But the Oracle of Omaha has also been putting more of his company’s money behind promising growth stocks in recent years. In fact, roughly 48% of the investment conglomerate’s stock portfolio is invested just in Apple, one of the world’s most high-profile growth stocks.

Buffett’s love for Apple is no secret, but growth-focused investors might want to home in on other potentially explosive technology plays in the Berkshire portfolio. If you’re interested in adding Buffett-backed growth stocks to your own portfolio, read on to see why two Motley Fool contributors believe that backing these tech leaders is a path to scoring big wins.

It will be hard to beat Amazon in e-commerce

Parkev Tatevosian: Warren Buffett owns a collection of excellent stocks in his Berkshire Hathaway portfolio. One of my current favorites for long-term investors is Amazon (NASDAQ: AMZN). The online-bookseller-turned-everything-store has built a sustainable competitive advantage, capitalizes on the convenience of shopping online, and trades for a relatively cheap valuation considering its growth prospects.

Indeed, Amazon’s website, with millions of items and hundreds of millions of monthly shoppers, is an attractive option for businesses and consumers alike. The latter is attracted by the opportunity to reach millions of shoppers in one location. The former appreciate the selection and the fast and free delivery if you are a Prime member, among other perks. This approach has helped Amazon’s sales grow from $136 billion in 2016 to $514 billion in 2022.

Warren Buffett is undoubtedly attracted to companies that can grow sales at that clip. However, I have a hunch that Buffett is more interested in the operating profit, which increased from $4.2 billion to $12.2 billion in the same years mentioned above. After all, it’s easier to increase sales than it is to increase profitability. Lately, that’s thanks in large part to Amazon’s cloud computing business — Amazon Web Services — where it holds the highest market share.

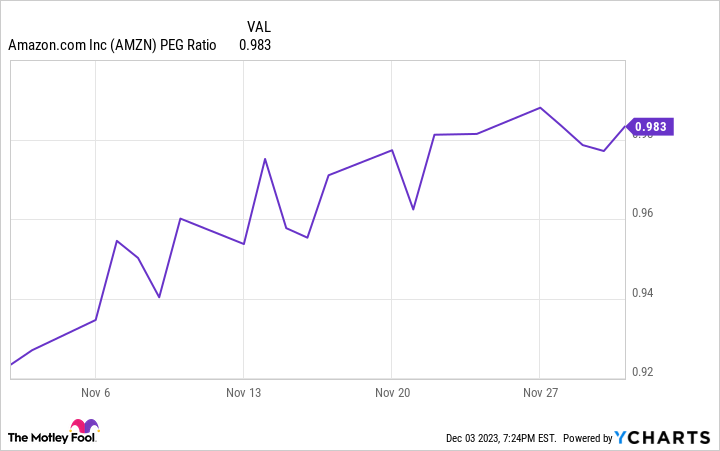

Fortunately for investors, Amazon is also trading at a reasonable PEG ratio of 0.98. Anything less than 1 indicates an attractive valuation.

This stock is unique in Berkshire’s portfolio

Keith Noonan: Believe it or not, Berkshire Hathaway has only invested in one initial public offering (IPO) stock since Warren Buffett became the company’s CEO in 1965. That company is Snowflake (NYSE: SNOW), a leading provider of data-warehousing services and analytics tools.

Snowflake’s Data Cloud platform makes it possible for businesses and institutions to combine, analyze, and act on information that’s generated from otherwise walled-off cloud infrastructure systems. While the company, a provider of highly technical services, is far from being a household name, its technologies are helping customers make sense of Big Data and stay competitive at a time when artificial intelligence (AI) is changing the world.

These days the vast majority of large organizations use cloud infrastructure services from multiple providers. But there are often barriers to combining and analyzing information that originates across Amazon, Microsoft, and Alphabet‘s respective services.

Snowflake’s Data Cloud helps solve that problem, and it also provides additional tools for data analysis, visualization, and utilization. The company also offers a cloud-based platform for building, launching, and scaling analytics-heavy applications. Being able to access and analyze the widest possible breadth of valuable data is a crucial competitive factor in AI, and it’s at the heart of success for many large organizations.

Even in the face of shifting macroeconomic conditions and uncertainty, Snowflake has continued to post encouraging growth.

The business’ product revenue increased 34% year over year in its third quarter to reach $698.5 million, and its total number of customers with trailing-12-month product sales of more than $1 million soared 52% to reach 436.

Thanks to strong sales growth and improving margins, non-GAAP (adjusted) free cash flow jumped to $111 million, up 70% compared to the prior-year period. The company’s expansion story could still be in the very early stages of unfolding.

With shares still down roughly 50% from their lifetime high, Snowflake is a Buffett-backed growth stock that has the potential to deliver explosive returns for long-term investors.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 7, 2023

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Noonan has no position in any of the stocks mentioned. Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Snowflake. The Motley Fool has a disclosure policy.

2 Warren Buffett Growth Stocks to Buy Now and Hold Forever was originally published by The Motley Fool